Keeping good accounting and tax records is essential for small businesses. The most common reason for businesses not keeping good accounting records is mainly because business owners just don’t know where to start.

Today, I will share with you the manual system that I give to my clients to use and it is the one I personally still use. Once you start using a system like this, you will get more comfortable with filing and you will most likely tweak a little to better suit your individual needs.

I fully understand just how time poor business owners can get. How many of you dread BAS lodgement time? Chances are that you find yourself sailing close to the wind. The BAS lodgement deadline is fast approaching and you can’t actually prepare your BAS until you locate all of the receipts so you can update your accounting file and reconcile your bank account. Generating the BAS report is the easy bit, it is all the other mundane stuff that you always leave to the last minute that keeps you up at night & stresses you.

I can absolutely assure you that if you follow this system:

- you will never have to stress about gathering your receipts at tax time only to find you have misplaced some. Lost receipts = lost tax deductions and you will end up paying more tax (and maybe GST) than you should.

- you will never lodge another BAS late

- you will not incur ATO late lodgement penalties

- you will always be able to produce a receipt to substantiate your tax deduction claim in the event of an ATO audit

- you will better understand how your business is going & will be able to make more informed business decisions as your accounting software always be up to date.

You are probably thinking that I must have a special power to be able to see all these business owners scrambling around at the same time every quarter, days out from BAS lodgement deadline screaming at their spouse, their children, working late at night or having to miss out on that weekend social function just to get their bloody BAS lodged on time. Well I could tell you this, but guess what, I didn’t always practice what I preached. Sure I had all the nice filing systems setup, I had all the good intentions, but things just got busy in my business and I would leave the filing & my data processing until the end of each quarter. Now I do my filing either when I take the receipts or bank statements into my office, or at least weekly. I cannot believe how organised it has helped me become and I can pretty much be in a position to have my Profit & Loss prepared by the 7-10th of each month and the BAS prepared and ready to lodge within 7-10 days of the end of the quarter. This has significantly reduced my stress levels and lets me get on with my work for the month and striving to reach my monthly goals.

My system is based around three (3) areas to file your receipts depending on where you are and how much time you have. They are :

- mobile (for when you are out & about)

- temporary (for you to gather receipts in one safe place until you have time to file permanently)

- permanent (for you to refer back to locate a receipt or to provide to the ATO in the event of an audit).

MOBILE FILING SYSTEM

A small expanding wallet is perfect for this. I use the one above available from Officeworks – http://bit.ly/MOBILEFILINGSYSTEM

This is great for keeping in the car and should be used instead of the car glovebox, console or floor!

It could also be carried around in your handbag and used instead of filing receipts in your wallet.

I recommend that you label each of the sections for each type of expense eg. car expenses, office supplies, personal, medical.

TEMPORARY FILING SYSTEM

A desktop filing system should be used daily or weekly and will house your receipts until you have time to permanently file.

A desktop set of filing drawers is perfect and available at Officeworks – http://bit.ly/FILINGDRAWERS.

You can label the drawers however you like but I like to have at least the following:

- bills to pay

- receipts

- filing

As you open your bills, pop them in the “bills to pay” drawer and then when you want to pay bills, you can do so in a batch which will save you time and will save you from having to go searching in the kitchen, desk drawers, bedside table etc. and potentially save you late payment fees.

As you pay your bills or bring home receipts, file these in the “receipts” drawer. You may also want to a separate “receipt” drawer for personal receipts as it will make it easier at the month when you need to file them somewhere permanent.

PERMANENT FILING SYSTEM

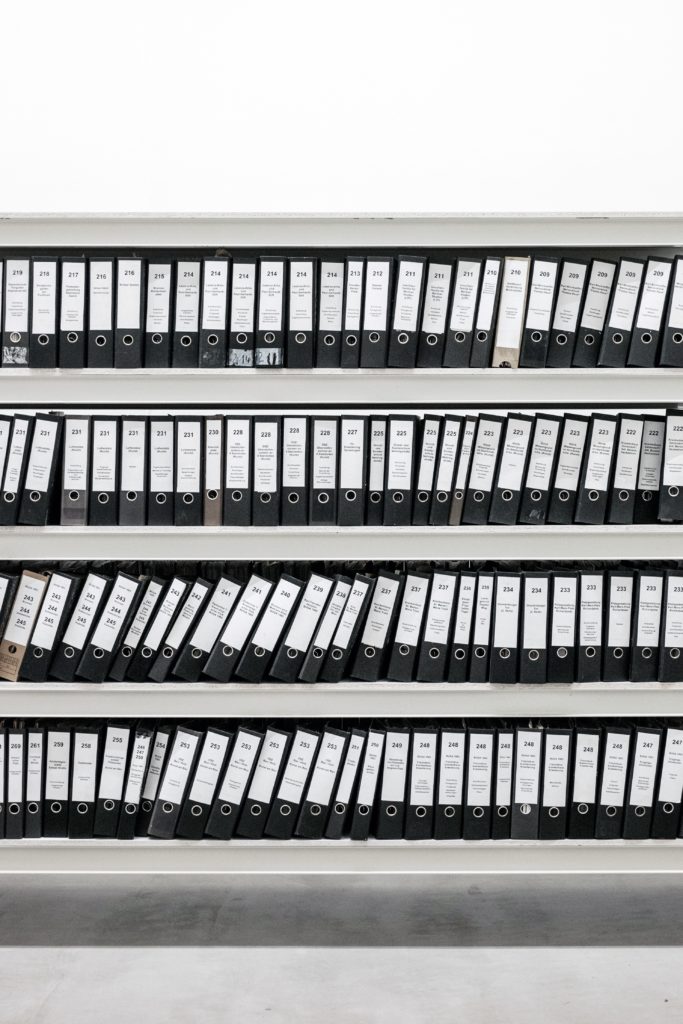

I then use a lever arch filing system that I transfer all receipts into at the end of the month and a separate folder for bank statements. If you have multiple bank accounts, loan accounts and credit cards insert a divider for each account.

Good quality lever arch folders with a spine that can be easily labelled are perfect.

At the beginning of the financial year, insert month dividers – start with July and finish up with June. This may be different to how you currently file. I know years ago myself and my clients may have filed according to expense type. The monthly system works much better these days as if you are subjected to an ATO audit, they are usually isolated to a particular quarter. All you need to do is produce those 3 months of receipts to the audit. If your business has lots of receipts, I would setup your system with either 12 lever arch folders (one for each month) or 4 lever arch folders (one for each quarter) instead of 1.

An extension of this system is to keep separate folders depending on the way you pay for the expense ie. RECEIPTS – business cheque account, RECEIPTS – credit card, RECEIPTS – cash, however if you are a small business and don’t have that many receipts or are short of space in your office, just use one folder for all receipts and then divide each month’s section with a coloured piece of paper of you would like to keep separate.

At the end of each month sit down with your bank statement(s) folder. Start at the beginning of the statement, find the relevant receipt, tick off/highlight the amount on the bank statement and file. By filing in this order, it is easy to go back and find the invoice if you need it for warranty etc. For any amount not highlighted, go searching for the receipt or request another one from the supplier if possible. This practice will ensure that you have documentary evidence should you be subjected to an ATO audit and also that will be able to maximise your tax deductions at the end of the year. If you are using a computerised accounting package, bring through your bank feed and go through the bank statement on the screen approving the expense allocation as you cross reference against the receipt. What is remaining on the screen will be receipts you need to go hunting for.

I also keep separate folders for my personal expenses – I don’t keep every receipt just ones that I may need for warranty purposes or that I may want to refer back to eg. electricity bills, house insurance. This folder will also come in handy to use if you prepare an annual household budget as you can quickly ascertain what you spend on household expenses.

I note that my system described above is a manual one and many business owners will prefer to use an electronic filing system. If this is the case you can use many of the record keeping apps on the market, however it is still good practice to have some sort of end of month process that you compare your electronic copy of receipts to the bank statement.

Whether you are using a manual or an electronic filing system, the secret to having good accounting and tax records is to decide on a system that works for you and then STICK to it ALL YEAR.

I hope this has given you some inspiration and motivation to start the 2017 year with a great record keeping system. GOOD LUCK!

Click HERE to get your FREE Easy Filing System Checklist!