How much do you know about cloud accounting?

How much do you know about cloud accounting?

If you are a tad in the dark, hopefully by reading my blog you will not only be enlightened but encouraged to take the leap.

If you have already taken the leap, you may get a few extra tips to save you even more time and start to get even better value from the software.

How about we start with what options you have for keeping your accounting records?

- Manual system – shoebox, folder, handwritten cashbook

- Electronic system – excel spreadsheet

- Commercial accounting package with the data saved on your desktop

- Commercial accounting package with the data saved in the cloud

So what is cloud accounting? Basically your accounting data is stored on remote servers similar to the servers that you access to retrieve your internet banking details.

Most of my clients have cloud accounting software and they love it – so do I! The products my clients use are either MYOB or Xero so I am only going to refer to these providers for simplicity. I suggest that once you are armed with the basics that I share with you, speak with your bookkeeper or accountant to ascertain the package that they recommend for you. In saying that, if they are not advocating the use of accounting cloud software you may want to get a second opinion off another bookkeeper or accountant.

“The only way to make sense out of change is to plunge into it, move with it, and join the dance”

– Alan Watts –

My clients that have their accounting software in the cloud are experiencing the following advantages:

- they are saving time

- they are saving money

- they are having quicker access to their financial information

- they are having more accurate financial information

- they are able to work & check-in remotely

- they are able to access their financial information from mobile devices*

- they are able to invoice from their mobile devices and even take payment*

- we are able to review the file anytime without the need to drop a copy to us

- we are able to make real-time changes to their file (even if they are using it too)

- we are able to login to their file while we are on the phone to each other to assist & advise

- there is no need to enter lengthy adjusting journals or roll files over at the end of the year as we make all of our changes directly into the file

- depends on which version of software you have

I thought I would dispel some of the myths that are being circulated to help you better understand the advantages as you too may have heard mixed information. Feel free to share this information with your friends, bookkeepers, accountants and colleagues.

MYTH 1: CLOUD ACCOUNTING ISN’T SECURE

The biggest advantage of cloud accounting is the automatic bank feeds. Bank feeds automatically imports transactions into your accounting file directly from your bank or other financial institution.

This is very easy to setup and is very secure – neither the software company, your staff, your bookkeeper or your accountant can transact on your account via your file. What happens is that your bank either daily, weekly or monthly sends the data transactions through to MYOB or Xero and they are imported directly into your file. The technology is super intelligent as it either uses a rule that has been setup by yourself, your staff, your bookkeeper or your accountant or it just remembers where the transaction was coded before and does that again. This eliminates the need for anyone to do those boring and repetitious tasks such as data entry.

You will see when you login to the file and go to the appropriate area, the account that the software is suggesting that the transaction be coded to. All you or your bookkeeper needs to do is hit APPROVE! You do have the choice to change the account at this stage or later on if you realise that the wrong code was used.

If you are doing manual data entry you are wasting your time. If you are paying someone else to do manual data entry you are wasting their time and your money. We and many of our accounting and bookkeeping colleagues are hearing lots of resistance & excuses from other accountants and bookkeepers as to why they do not want to embrace this new technology. Like all changes, a common reason for resistance is that people do not have all of the information, they do not understand the new way of doing things and they are nervous that it will affect their income levels. The sad thing with this attitude is that by not embracing the changes early on, they may find themselves losing business to more proactive accountants or bookkeepers of which there are many!

MYTH 2: CHANGING FILE TO A CLOUD FILE WILL COST MORE MONEY

Many bookkeepers are advising their clients that it will cost them more money to change their file to the cloud.

We do a small amount of bookkeeping for clients, but most of our clients do their own bookkeeping or engage bookkeepers so we have no vested interest in disputing this fact.

Many clients are already paying an annual or monthly subscription fee to MYOB and this qualifies you to have a desktop or a cloud file, so there is NO ADDITIONAL COST. You will however save time and money with the reduction in manual data entry.

Some clients do not own an accounting file of their own and are instead using a file owned by their bookkeeper or accountant. For files of this type, bankfeeds are not available so all of your transactions need to be data entried. You may be saving the cost of having a monthly subscription, but you need to compare this with how much you are paying monthly for bookkeeping?

MYTH 3: CLOUD SUBSCRIPTIONS ARE TOO EXPENSIVE

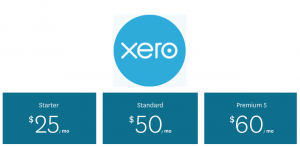

So how much does it cost to have a cloud file?

Both MYOB and Xero have many products depending on your needs and your budget. We recommend that you speak to your bookkeeper or accountant so that they can recommend the most appropriate and most cost effective product for you and your business. At the time of posting, the following prices are current.

MYTH 4: YOU NEED GOOD INTERNET

Both MYOB and Xero utilise the internet so you do need to consider the speed & stability of your internet.

When we are evaluating the best product for your business we do consider your internet access together with your computer hardware.

In a nutshell, Xero is completely a web based product so you can only access over the internet ie.online. MYOB however, can be used both online and offline so if good internet is a problem in your area your choices of provider may be reduced.

MYTH 5: YOU WILL BE LOCKED IN TO ONE COMPANY

Just like any other business decision, ideally you make the right decision from day one as to the best product and provider for your circumstances. If your circumstances and needs change, there is an opportunity to swap products and providers. Just make sure that you ask the question before you sign up if there is a minimum contract period.

WHAT TO DO NEXT …………………

I believe cloud accounting software is equally beneficial whether you have a small, medium or large sized business. Who wouldn’t want up to date accounting data at your fingertips in a timely manner to see how profitable their business on a daily, weekly and monthly basis is each week? Who wouldn’t want to make informed make business decisions?

As already alluded to, your next step should be to speak with your business colleagues, your bookkeeper and your accountant to ascertain the packages that they recommend.

I can assure you, you won’t know yourself and you will be wondering why you hadn’t ditched the shoebox, or a manual, outdated system years ago.